Where Expertise

Meets Excellence.

We think beyond what’s happening right now and are always planning for the future of our clients in all aspects of their life and business. Our goal is to set you up for success.

Services

We are here for you, no matter what you need.

We’re your partners in success, and our relationship with our clients is very important to us. Our team of financial professionals is dedicated to making the numbers work out for the people we work with.

About Smolin

Exceptional Client Service from Trusted Advisors.

When you work with Smolin, our relationship is based on trust. We’re committed to being your best resource for financial and accounting services – no exceptions.Since 1947, we’ve proudly served our clients with professionalism, integrity, and industry-leading strategies. Our innovative tax and accounting services have helped countless businesses grow and thrive in the always evolving areas of taxation.

Industries

Whatever you do, we get you.

Whether it’s Healthcare, Manufacturing, Biotechnology or another specialized industry – we have unique experience across a wide range of industries, bringing you specialized solutions to meet your specific needs. We know the language of your business and the many challenges that confront you—and we’re here to help.

Our People

building a culture of excellence.

Our people are at the heart of everything we do. We’ve created a culture that balances hard work with fun, where collaboration, growth, and innovation thrive. From professional development to office celebrations, we ensure our team feels valued, supported, and part of a community that works—and plays—together.

Latest News

thoughtful insights, always.

Stay informed with Smolin’s latest news and expert insights. From tax updates and accounting trends to firm achievements and community involvement, we’re dedicated to keeping you in the know.

Letter of Instruction: The Missing Piece in Your Estate Plan

Letter of Instruction: The Missing Piece in Your Estate Plan https://www.smolin.com/wp-content/uploads/2026/02/Blog-Protect-Your-Estate-and-Your-Family-With-Co‑Executors-1.gif 266 266 Noelle Merwin https://secure.gravatar.com/avatar/f87906c71ef4fc22240caeece23e35ba3839bedb78954395321e4bcb39827b02?s=96&d=mm&r=gProtect Your Estate and Your Family with Co‑Executors

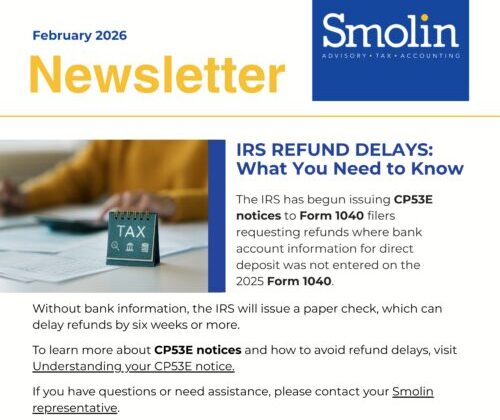

Protect Your Estate and Your Family with Co‑Executors https://www.smolin.com/wp-content/uploads/2026/02/Blog-Protect-Your-Estate-and-Your-Family-With-Co‑Executors.gif 266 266 Noelle Merwin https://secure.gravatar.com/avatar/f87906c71ef4fc22240caeece23e35ba3839bedb78954395321e4bcb39827b02?s=96&d=mm&r=gTax News: Form 1040 refunds

Tax News: Form 1040 refunds https://www.smolin.com/wp-content/uploads/2026/02/TaxRefunds.gif 266 266 Noelle Merwin https://secure.gravatar.com/avatar/f87906c71ef4fc22240caeece23e35ba3839bedb78954395321e4bcb39827b02?s=96&d=mm&r=gA Tax Decision Every Married Couple Should Revisit for 2025

A Tax Decision Every Married Couple Should Revisit for 2025 https://www.smolin.com/wp-content/uploads/2026/02/A-Tax-Decision-Every-Married-Couple-Should-Revisit-for-2025.gif 266 266 Noelle Merwin https://secure.gravatar.com/avatar/f87906c71ef4fc22240caeece23e35ba3839bedb78954395321e4bcb39827b02?s=96&d=mm&r=gTRACING THE MONEY TRAIL: How Hidden Transactions Can Shape a Case

TRACING THE MONEY TRAIL: How Hidden Transactions Can Shape a Case https://www.smolin.com/wp-content/uploads/2026/02/Introduction-to-Money-and-Finance-Education-Presentation-in-Green-and-White-Flat-Graphic-Style-LinkedIn-Post-1280-x-720-px-266-x-266-px-1.gif 266 266 Noelle Merwin https://secure.gravatar.com/avatar/f87906c71ef4fc22240caeece23e35ba3839bedb78954395321e4bcb39827b02?s=96&d=mm&r=gSmolin Relocates Spring Lake Heights Office to Expanded Red Bank Location

Smolin Relocates Spring Lake Heights Office to Expanded Red Bank Location https://www.smolin.com/wp-content/uploads/2026/02/Redbanknewoffice.jpg 266 266 Noelle Merwin https://secure.gravatar.com/avatar/f87906c71ef4fc22240caeece23e35ba3839bedb78954395321e4bcb39827b02?s=96&d=mm&r=gNew Trump Accounts – What You Need to Know

New Trump Accounts – What You Need to Know https://www.smolin.com/wp-content/uploads/2026/02/The-Expert-Edge-266-x-266-px.jpg 266 266 Noelle Merwin https://secure.gravatar.com/avatar/f87906c71ef4fc22240caeece23e35ba3839bedb78954395321e4bcb39827b02?s=96&d=mm&r=gWhen medical expenses are — and aren’t — tax deductible

When medical expenses are — and aren’t — tax deductible https://www.smolin.com/wp-content/uploads/2026/01/When-medical-expenses-are-—-and-arent-—-tax-deductible-__Blog.jpg 266 266 Lindsay Yeager https://secure.gravatar.com/avatar/49ce5f89ab9269ee004a4a8ae823885fd9d4a139a650247f1fa2378346b36b83?s=96&d=mm&r=gHow auditors evaluate accounting estimates

How auditors evaluate accounting estimates https://www.smolin.com/wp-content/uploads/2026/01/How-auditors-evaluate-accounting-estimates__Blog.jpg 266 266 Lindsay Yeager https://secure.gravatar.com/avatar/49ce5f89ab9269ee004a4a8ae823885fd9d4a139a650247f1fa2378346b36b83?s=96&d=mm&r=gLet’s Talk.

877.426.1040

info@smolin.com