The employer mandates of the Affordable Care Act (ACA) are quickly approaching. Although stiff penalties may be assessed if an organization does not meet requirements, many organizations lack an understanding of ACA and what is required of their businesses.

The employer mandates of the Affordable Care Act (ACA) are quickly approaching. Although stiff penalties may be assessed if an organization does not meet requirements, many organizations lack an understanding of ACA and what is required of their businesses.

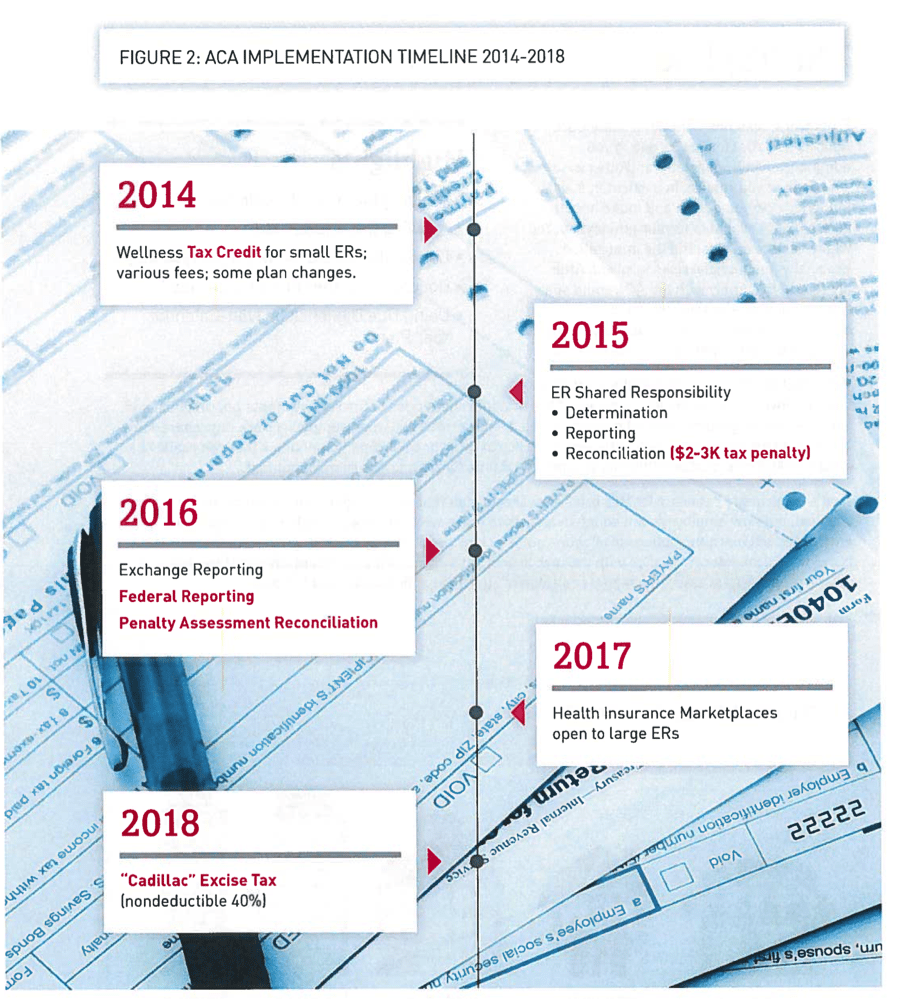

Following the ACA compliance timeline below can help your organization become prepared to meet all ACA standards.

2014 ACA Compliance Timeline

- Organizations that offer wellness plans can receive tax credits for up to 30 percent of the employer cost of those plans. This percentage rises to 50 percent for wellness programs that seek to end tobacco use.

- Small employers with fewer than 25 full-time equivalents (FTEs) are eligible for tax credits in order to offset the cost of offering coverage to employees.

2015 ACA Compliance Timeline

Beginning in 2015, employers with more than 50 FTEs are required to provide health coverage to employees and document that coverage to avoid fines. Small employers are exempt from penalties.

- FTEs are defined as employees who average more than 30 hours of service per week. Service hours include hours worked, paid time off and government mandated paid time, like FMLA.

- Employers must offer health coverage to 70 percent of eligible FTEs to avoid penalties.

- Comprehensive reporting of health coverage and covered employees must be provided to the IRS on a monthly basis.

- At the end of the plan year, employers must provide summary reporting to the government as well as employees for tax purposes.

2016 ACA Compliance Timeline

In 2016, the provisions of the ACA become permanent.

- Employers must offer coverage to 95 percent of eligible FTEs to avoid penalties.

- Summary reporting of the 2015 plan year is required to employees and the IRS. Failing to submit this report to employees by January 31, 2016 can result in penalties.

- If penalties were accessed, businesses must respond to prove that the penalty was not just. This can only be accomplished through thorough documentation of the eligibility and notification processes.

2017 ACA Compliance Timeline

Prior to 2017, employers with more than 50 FTEs were not eligible to purchase health coverage through the health care exchanges. This option was limited to individuals and small employers. Selecting coverage through a health care exchange can result in additional competition, which may ultimately decease an organization’s cost for providing healthcare.

2018 ACA Compliance Timeline

The IRS has set maximum thresholds for the total cost of health coverage. This amount includes all premiums, whether they are employer or employee paid. The limits are:

- $10,200 for an individual plan.

- $27,500 for a family plan.

In the event the total cost of health coverage exceeds these amounts, the employer is responsible for a 40 percent excise tax. For example, if a family plan is $28,000, it exceeds the maximum of $27,500 by $500. The employer is this responsible for a 40 percent tax of $200 on the excess cost.

Many employers are under the impression that these thresholds are set high enough that it is unlikely to reach them. However, given the rising cost of insurance, ADP forecasts that many companies will reach this limit by 2018 unless changes are made to their health care plans.

Implementing ACA compliance within your organization will require time and resources. Several different departments will need to partner together to ensure provided health care plans meet ACA requirements, that record keeping procedures are in place and to review employee hours monthly to ensure eligible employees are made aware of their status. A qualified consulting firm can provide assistance with ACA implementation compliance.

(Figure 2 provided by ADP)